Greece may be a perennial hotspot, but it’s far from the only Mediterranean gem worth noting. Looking to expand your travel horizons? It’s time to set your sights on Cyprus.

Originally settled by Mycenaean Greeks, the island nation offers archaeological ruins, ornate churches, and mouth-watering traditional cuisine. Add to that stunning natural scenery.

Another benefit of this low-key locale is that it’s far less touristy and much cheaper than its flocked-to counterpart. That’s good news for both crowd-averse and budget-conscious travellers. And according to the European Union’s 2012 Eurobarometer study, 73% of the country speaks English.

Source: USA Today

Print & Play Activities

Paper Tube Butterfly – Instagram Vs Reality

-

Imperio Butterfly

-

Colouring pages

-

Connect the dots

Paper Tube Butterfly | Materials:

WHAT YOU WILL NEED

- Paper tube (empty toilet paper rolls)

- Pipe cleaner

- Black marker

- Paint and brushes or

- Colour pencils / markers etc

- Scissors

- Glue or adhesive tape

- Small pom pom (optional)

*Always supervise baby and toddler activities*

Colouring pages | Materials:

WHAT YOU WILL NEED

- Colour markers

- Paint and brushes

- Colour pencils / markers etc

- Scissors

- Small pom poms or other decorative craft materials (optional)

*Always supervise baby and toddler activities*

Connect the dots | Materials:

WHAT YOU WILL NEED

- Black marker

- Pencil or pen

Optional: - Colour pencils / markers etc

*Always supervise baby and toddler activities*

[wpdm_package id=’11519′]

Cyprus President Nicos Anastasiades, Greek Prime Minister Kyriakos Mitsotakis and Israeli Prime Minister Benjamin Netanyahu attended in Athens Thursday the signing ceremony for the accord to construct the Eastern Mediterranean natural gas pipeline.

The 1,900-kilometre (1,181 miles) link will connect recently discovered, and to-be-found, gas fields in the eastern Mediterranean basin with European markets through Cyprus, Greece and Italy. The project is being developed by IGI Poseidon SA, a joint venture of Greece’s state-owned supplier Depa SA and Edison SpA. Italy is set to sign the agreement at a later date.

Kyriakos Mitsotakis, center, Benjamin Netanyahu, right, and Nikos Anastasiadis shake hands in Athens on Jan. 2. Photographer: Aris Messinis/AFP via Getty Images

“Today, we did not just sign an advantageous agreement, but also cemented our decision for strategic engagement in a region that’s in need of cooperation,” Mitsotakis said at the ceremony. “EastMed is not a threat to anyone.”

The accord comes just as tensions are increasing in the region after Turkey’s contentious agreement that delineates maritime borders with Libya and affirms claims to areas of the Mediterranean the pipeline may cross. The three signatory countries all oppose the deal.

Gas Finds and Maritime Claims in the Mediterranean

Israel’s cooperation with Cyprus & Greece “adds to security and prosperity in the region” and “we are not turning against any other country,” Netanyahu said.

The deal allows for other countries to join the project, Anastasiades said.

EastMed is not intended to send a message to Turkey, but to promote cooperation in the energy sector at a regional level, Greek Energy Minister Kostis Hatzidakis said Dec. 24.

Turkey’s Foreign Ministry spokesman Hami Aksoy said the agreement was a “futile” attempt to exclude Turkey and the breakaway Turkish Cypriot state from the energy projects in the region, adding that Turkish Cypriots have equal rights to the island’s natural resources.

“Turkey is the most commercially feasible and secure route for the utilization of the natural resources in the Eastern Mediterranean and their transfer to the consumer markets in Europe, including Turkey” Aksoy said in a written statement late Thursday. Any project that disregards Turkey “cannot succeed,” he said.

The accord includes a clause for ensuring the security of the pipeline’s operations and contains a single regulatory framework for the facilitation of the project and a common tax regime that will govern it.

Gas purchase

Depa also signed on Jan. 2 with Energean Oil & Gas Plc a letter of intent for the potential sale and purchase of 2 billion cubic meters of natural gas per year from Energean’s fields in offshore Israel. The deal is considered a step for the project’s commercial viability and its realization. The amount represents 20% of the pipeline’s initial capacity of 10 bcm a year.

IGI Poseidon in December agreed to fast-track development of the EastMed pipeline and take a final investment decision within two years. The European Union has said it supports the project because it will help diversify its gas supplies and boost energy security. The target of the pipeline is to transport 20 bcm a year while the budget for the initial capacity stage is 5.2 billion euros ($5.81 billion).

U.S. Secretary of State Michael Pompeo also underlined American backing for the pipeline when he attended a Cyprus-Greece-Israel trilateral summit in Jerusalem in March.

— With assistance by Selcan Hacaoglu, and Constantine Courcoulas

Source: bloomberg.com

Cypriot Finance Minister Harris Georgiades discusses the upgrade of the country’s credit rating, the banking sector, Russian investment in Cyprus, their ties with Turkey and trade relations with the U.K. He speaks exclusively on “Bloomberg Markets: European Open.” (Source: Bloomberg)

Full video available here

As Mr Georgiades twitted earlier, “Telling the story of a successful recovery, 4% growth, 3% budget surplus, & offering a commitment that fiscal discipline & promotion of reform agenda will be maintained. Aim is to broaden productive base of economy, fully heal banking sector & enhance competitiveness.”

The Cyprus Investment Promotion Agency (Invest Cyprus), presented the investment opportunities that Cyprus can offer in view of Brexit, in an event that took place in London, on the future of Europe and Cyprus. The event, which was co-organised by the Agency and Bloomberg, took place on Friday, 21st September at the new headquarters of the international news agency, under the auspices of the President of the Republic, Nicos Anastasiades.

In the framework of the event, panel discussions divided into three thematic areas were organised. Crucial actors of the Cyprus financial scene took part in the discussions, including Minister of Finance, Harris Georgiades and Minister of Energy, Commerce, Industry and Tourism George Lakkotrypis. Participants included also President of the Cyprus Securities and Exchange Commission, Demetra Kalogerou, Managing Director of the Central Bank, Constantinos Herodotou, CEO of Bank of Cyprus John Hourican, CEO of Hellenic Bank Ioannis Matsis, CEO of Deloitte Cyprus Christis Christoforou, Executive Director of PwC Kyriacos Kokkinos, Managing Director of KPMG Demetris Vakis, shareholder of EY Cyprus Stelios Demetriou, Director of City of Dreams Mediterranean and Melco Resorts & Entertainment, Andy Choy and president of Columbia Shipmanagement LTD, Mark O’Neil.

Levante Residences elatedly represents luxurious apartments set in a contemporary design complex nestled in the heart of the Yermasoyia area of Limassol. Close to a wide range of amenities and the bustling city of Limassol, Levante Residences establishes the standard for luxury living with its striking interiors, fitting location and impressive communal services.

Within this gated complex, a communal swimming pool and outdoor garden space can be found for everyday outside entertainment and pleasure, for both children and adults, especially suitable for the warm summer season.

Occupancy: 06/2020

See Project

Начать разговор с темы высотного строительства было вполне логично, ведь Яннис Мисирлис сейчас строит один из самых необычных небоскрёбов Кипра. Его экспертное мнение имеет немалый вес, потому что под брендом Imperio уже построены десятки жилых домов и несколько крупных офисных центров. Впрочем, Яннис не ограничился темой строительства и поделился своим видением касательно будущего Лимассола и всего острова. Например, наш собеседник предложил рассмотреть возможность превращения Кипра в центр авиаиндустрии: для этого можно и нужно использовать успешный опыт работы шипингового сектора.

– В последнее время высотное строительство в Лимассоле подвергается резкой критике. Основные вопросы – отсутствие генерального плана Лимассола, сомнительная эстетика высоток и блокирование ими вида на море для остальных домов, которые из-за этого теряют в стоимости. Каково ваше мнение на этот счёт?

– Высотки не могут портить внешний вид города, они – его неотъемлемая часть. Вспомним Нью-Йорк, Лондон или Чикаго – их ландшафт является символом делового мира. Лимассол, конечно, не сможет стать вторым Манхэттеном или Дубаем: в ближайшие несколько лет мы увидим законченными не более десяти высотных зданий.

Read more Cyprus Business

Living at Jasmine Residences offers a unique and pleasurable experience to all the residents. The signature interiors by Imperio bring a warm yet contemporary design edge to the project, transforming the residences into sophisticated, art-filled homes maximising the internal floor space and the abundant, natural light. All the rooms co-exist and complement each other, creating exceptional living areas that are perfect for relaxation and ease.

Occupancy: 04/2020

See Project

To check out ‘Exclusive 17’, click here.

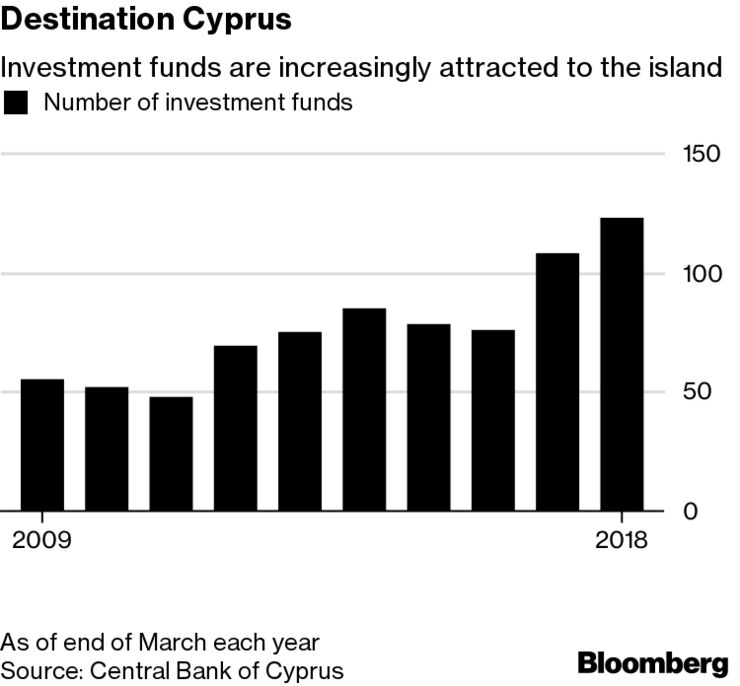

Assets under management up 29% in first quarter to record high

Drawn by its location — straddling the regions of Europe, the Middle East and North Africa and with access to Eastern Europe, Russia and former Soviet republics — flexible legislation and lower costs, Asian funds are using Cyprus for their single European Union passport for investment across the bloc.

“There is an increasing trend for funds from countries who traditionally didn’t have strong economic ties with Cyprus such as China, India and even Japan, to establish a base in the country as their gateway to the EU,” Andreas Yiasemides, Vice President of the Cyprus Investment Funds Association, said in an interview in Nicosia.

The number of investment funds and assets under management have hit record highs, according to the Central Bank of Cyprus. At the end of March the number of funds rose to 123 from 110 at end December. Total assets under management rose by about 29 percent to 4.45 billion euros ($5.24 billion) from 3.45 billion euros. In Dec., 2008 there were 55 funds with 1.23 billion euros in assets under management.

Interest for the setup and authorization by the Cyprus Securities and Exchange Commission of alternative investment funds runs strong, its Chairwoman Demetra Kalogerou said.

“There are 60 applications at this moment for different fund structures,” she said. “Of these, 44 have been pre-approved, subject to fulfilling certain conditions.”

Flexible legislation

While Cyprus’s existing funds framework legislation applies EU directives and regulations, the country is introducing additional changes to make the island even more attractive for investors and fund and asset managers to register and manage funds, said Marios Tannousis, Board Member and Secretary of CIFA.

These include legislation that will enable investors to know from the beginning the tax regime applied to the different types of funds, a fast-track procedure for launching so-called registered alternate investment funds and the establishment of a new category of investment managers known as mini-managers who will be licensed to operate below current alternative investment fund manager thresholds, he said.

Cypriot legislation for establishing funds is much more flexible than elsewhere in Europe, but investors remain well protected, Yiasemides said. Costs in Cyprus are much lower than elsewhere in the EU and that is very important for small and medium-sized fund managers that Cyprus is seeking to lure. “We can’t become Luxembourg from day one and so we aim to attract funds that take cost into account,” he said.

Domestic investment

A physical presence in Cyprus also means funds contribute to the country’s domestic economy, renting or buying offices and paying fees to the state. They can carry out investments, especially in real estate, Yiasemides said.

Kylin Prime Fund, a Sino-European manager, established the Kylinprime Investment Fund in Cyprus as an alternative investment fund for the island’s assets. It invests in real estate, land development and infrastructure projects in Cyprus, financial assets of Cypriot companies or Cypriot organizations, such as bonds, bills issued with Cysec approval, according to its website. It is also one of the very few funds authorized to raise capital under the Cyprus citizenship by investment program, the company says.

“We are receiving inquiries for domiciling funds in Cyprus from China and India, but also from the Middle East and Europe including from Switzerland, Italy, Greece and Germany,” Tannousis said. “There is also some interest from U.K. funds managers to have back up funds in the country as their EU base, ” he said.

— With assistance by Vassilis Karamanis

Source: Bloomberg