Residence permit is the permission from EU-countries to citizens of non-EU nations (also known as third country nationals) to stay for at least 3 months on the territory.

In line with Eurostat, 18,971 non-EU citizens were granted residence permits by Cyprus, in 2017. Citizens of India and Russia is the majority to which residence permits were granted.

The analysis of the residence permits that were granted to non-EU citizens by Cyprus, in 2017:

India – 4,710 (24.8%)

Russia – 2,883 (15.2%)

Nepal – 1,406 (7.4%)

Philippines – 1,317 (6.9%)

Sri Lanka – 1,200 (6.3%)

Others – 7,455 (39.3%)

Regarding Europe in total, employment opportunities, family reunification and educational opportunities are among the major purposes for issuing permits, according to the report.

The applicants declaring ‘Other reasons’ as their purpose for a residence permit in an EU-country, have the right to stay in that territory, although they are not permitted for work or international protection.

Also, the citizens of Ukraine (662 thousand) were provided with the highest number of permits by EU-nations while, the second highest number was Syrian citizens (223 thousand).

source: Eurostat

Panel Discussion: Anti-crisis Strategies in an Era of Economic Uncertainty

Yiannis Misirlis, speaks about the Property Investments in Cyprus during Best Invest Congress 2019.

Source: Youtube

Panel Discussion: Anti-crisis Strategies in an Era of Economic Uncertainty

Yiannis Misirlis, speaks about the Property Investments in Cyprus during Best Invest Congress 2019.

Source: Youtube

Panel Discussion: Anti-crisis Strategies in an Era of Economic Uncertainty

Yiannis Misirlis, speaks about the Property Investments in Cyprus during Best Invest Congress 2019.

Source: Youtube

Prospective overview at a conference with foreign investors

The Minister of Finance mentioned the government’s actions for turning around the economic state and addressing the challenges in the economy.

The Cypriot economy has entered a new promising period, Finance Minister, Haris Georgiadis, mentioned at the 4th Cyprus International Investors Summit in Limassol, reassuring all 150 and more foreign businessmen and investors for the great prospects Cyprus offers as an investment destination.

In his opening, Mr. Georgiadis recalled the difficulties that the Cypriot economy faced from 2009 to 2014, indicating that “that’s just a history of the past” and that today, Cyprus is one of the fastest growing economies in the EU.

Moving on, Cyprus is enjoying a revival, which is offering business and investment opportunities in all sectors and he noted that by the end of the year and after 5 consecutive years of the economic upturn, it will have added almost 19% to its Gross Domestic Product.

“We have covered the lost ground and we expect the growth rate to remain above 3% annually for at least the next 3 years”, he added.

The Minister of Finance mentioned the government’s actions for turning around the economic state and addressing the challenges in the economy, emphasizing that there is currently a fiscal surplus of 3% of GDP.

He added that we have to maintain this stable financial performance, “because the public debt is admittedly high, as a result of the rescue of the banking system but also of the excessive deficits of the past”.

Among other things, he talked about the fiscal incentives that the Government has adopted over the last year and a half, which, as he said, include measures to encourage Research and Innovation, capital formation and the film industry, as well as loan restructuring measures.

The Minister of Finance noted that all key sectors of the Cypriot economy, such as tourism, shipping, real estate and services are doing very well and that “the production base of the economy is gradually expanding into new territories that include Higher Education, Research and Innovation, natural gas, Renewable Energy Sources and the management of investment funds”.

“It is the government’s job to create conditions of stability and confidence to create a business-friendly environment, allowing the productive forces of the economy, effectively allowing the private sector, to do its job”, he said, adding that “that’s what makes the economic growth sustainable”.

At the same time, Haris Georgiadis noted that the Government is watching the developments in the region, the EE and the world, expressing his concerns about the growing volatility and the growing tensions concerning the world trade and the stand that the free market and the multilateral cooperation must continue to define global relations.

Furthermore, he said that the Government is following closely the Brexit developments and expressed his hope that this would happen on the basis of the EU’s agreement with the United Kingdom, while he pointed out that, otherwise, “we are not panicking since the comparative advantages of the small open economy of Cyprus can mitigate any possible negative effects”.

Conclusively, he reassured the foreign businessmen and investors that the Government remains committed to maintaining the fiscal discipline, but also to continuing to pursue an ambitious reform agenda in order to reinforce our competitiveness and the prospects of our economy.

“This is also my message to you. You must feel secure, welcome and seek the business and investment opportunities that Cyprus has to offer you”, he added.

For his part, the Director of Invest Cyprus, Michalis Michail, welcomed the fact that for the fourth year the conference gathers the interest of investors and businessmen from various sectors, who have the opportunity to see up close the investment-friendly economic environment of Cyprus.

Source: CNA (Cyprus News Agency)

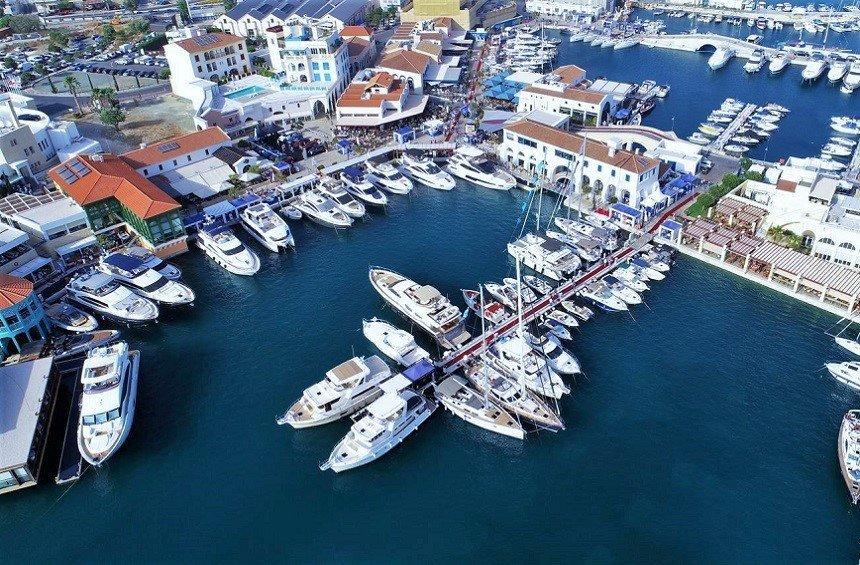

Limassol is evolving into a top seafaring destination, and the recent international distinction awarded to the Limassol Marina, ranking it among the top 5 marinas worldwide, is a testament to this.

The ‘5 Gold Anchor Platinum’ Award, which was announced during the opening ceremony of the Limassol Boat Show 2019, is the highest distinction awarded to marinas, and it is based on 89 separate criteria that act as indicators of excellence of the marina’s customer services and facilities. This global scheme, which is jointly administered by the UK’s The Yacht Harbour Association and Australia’s Marina Industries Association (MIA), aims at raising quality standards in marinas across the world.

With a particular focus on the facilities, customer service and infrastructure offered by each marina, this scheme helps customers in the evaluation and selection of marinas that are best aligned to their needs, while at the same time contributing to continuous business improvement.

The award acts as proof of the Limassol Marina’s unparalleled concierge services and its continuous commitment to maintain its facilities and services to the highest standards. As the Limassol Marina is the ultimate ambassador of the Cypriot yachting industry abroad, this award serves to strengthen the image of the island worldwide. It is worth noting that the Limassol Marina has previously received major awards and distinctions, such as the ‘5 Gold Anchor’ and ‘Blue Flag’ awards, which reflect its commitment to the protection of the environment and best practices.

Fitch Ratings has upgraded Cyprus’ sovereign rating to investment grade, ‘BBB-‘ from ‘BB+’, with a stable outlook as the island expects a 2.7 per cent fiscal surplus this year and continuous growth that will boost receipts.

The upgrade followed similar action by Standard and Poor’s last month.

Finance Minister Harris Georgiades took to Twitter to thank everyone for their contribution.

“Forging ahead,” he added.

Fitch said the upgrade reflected the buoyant fiscal revenue and prudent fiscal policy, which will see Cyprus record a fiscal surplus of 2.7 per cent of GDP in 2018, compared with a target of 1.7 per cent in the April 2018 Stability Programme Update.

“We forecast the fiscal surplus will remain high at 2.4 per cent and 2.2 per cent of GDP in 2019 and 2020, respectively, compared with 3.1 per cent and 2.9 per cent targeted in the 2019 Draft Budgetary Plan. Robust economic growth will boost fiscal receipts, while previously adopted hiring freeze and collective agreements will likely limit growth in the wage bill.”

The rating agency said the island’s public debt will remain on a firm downward trajectory despite a one-off expected increase this year following the placement into Cyprus Cooperative Bank (CCB) of €3.19bn in government bonds (15.5 per cent of GDP) to facilitate the acquisition of part of the state-owned bank by Hellenic Bank.

The move will raise the debt to 104.4 per cent at end-2018 from 95.7 per cent in 2017.

“However, we expect large primary surpluses, robust growth and contained nominal effective interest rates will reduce GGGD/GDP to 70 per cent of GDP by 2027.”

The ratio of non-performing exposures (NPEs) to total loans fell to 40.3 per cent in the first half of the year from 44 per cent in 2017, partly supported by the announced securitisation by Bank of Cyprus (BoC) of €2.7bn gross NPEs.

The acquisition by HB of CCB’s good assets and the subsequent transfer into a run-off entity of CCB’s €5.7bn NPEs portfolio are estimated to have led to a further decrease in NPEs to 30 per cent in September 2018.

“This will support a substantial decrease in contingent liabilities stemming from the banking sector, although these remain large.”

Private sector debt and non-performing exposures remain high, however, at 226 per cent and 97 per cent of GDP in 1Q18, respectively, and constrain credit growth.

Household and corporate debt stood at 105 per cent and 121 per cent of GDP and a large part of the recent decline in such debt stemmed mostly from high GDP growth, debt-to-asset swaps, loan write-offs, rather than loan repayment.

“We expect private sector deleveraging will accelerate, however, as enforcement of new legal amendments, improving earnings and recovering house prices foster debt repayment. Economic growth will likely remain resilient to a faster resolution in NPEs as rising wages, a dynamic labour market and high household savings will help preserve disposable income and smooth consumption.”

Source: Cyprus Mail